About the Student Empowerment Fund

Making Illinois Higher Education Accessible

Established by Illinois Treasurer Michael Frerichs, the Student Empowerment Fund (SEF) is a $1.5 billion impact investment fund that provides Illinois borrowers with accessible, lower-interest private student loans. Coupled with Illinois’ 529 College Savings plans—Bright Start and Bright Directions—the Treasurer’s Office offers a full spectrum of programs to support Illinois residents attending public or private non-profit or not-for-profit higher education institutions.

Student Empowerment Fund Mission

The Student Empowerment Fund aims to invest more than $1.5 billion on a continuing and recurring basis to lower borrowing costs for Illinois residents and improve higher education access.

The SEF does not seek to compete with or replace the Federal Direct student loan program. Instead, it provides competitively priced private student loan options for students needing to fill a financing gap or refinance existing student loans at a lower rate. We encourage borrowers to explore federal loans options prior to taking out any SEF loans. The SEF’s mission is to empower low- and middle-income collegians and graduates to make confident decisions about student loans and debt.

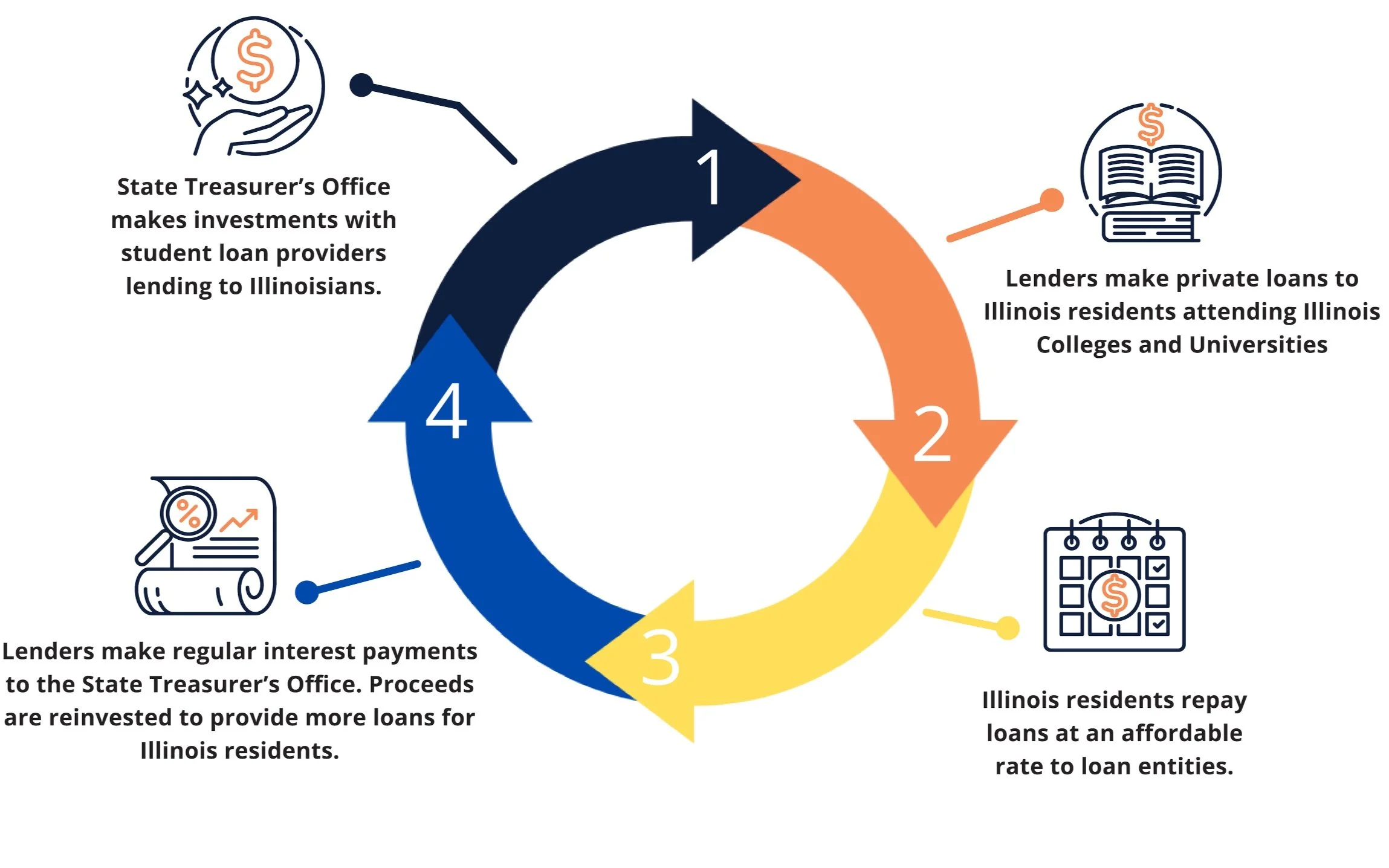

How the Student Empowerment Fund Works

The Student Empowerment Fund is not a direct lending program. Instead, the Illinois Treasurer’s Office loans capital to trusted firms providing competitively-priced private student loans. Approved lenders then offer private student loans to Illinois residents.

Student Empowerment Fund Investment Policy

SEF Investment Policy:

The SEF Investment Policy is designed to ensure that the Illinois Treasurer, as well as any contractors the Treasurer retains to provide services related to SEF, take lawful, prudent, and effective actions while supporting SEF. The Investment Policy is designed to allow for sufficient flexibility in the investment process to take advantage of investment opportunities as they arise while setting forth reasonable parameters to ensure prudence and care in the execution of SEF.